Pay Bills

Paying bills is as easy as the click of a button. Set up recurring payments so you never have to think twice.

Security Alerts

Choose to receive text or email alerts when a transaction is more or less than a specified amount or when your account falls below a set amount.

Deposit Checks

Simply take a photo of your check with your mobile phone and gain immediate access to funds up to $1500.

Card Controls

Taking control of your Freedom Credit Union debit and credit cards is easier than ever with our online and mobile banking. Right from your computer or phone, you can manage your cards anytime, anywhere, giving you peace of mind and added security. Whether you need to quickly lock a misplaced card, request a replacement, set a travel notice, or request a credit limit increase, it’s all at your fingertips.

Lock a Card

Instantly disable your card if it’s lost or stolen, preventing unauthorized transactions.

Replace a Card

Request a new card directly through the online/mobile platform if yours is damaged, lost, or stolen.

Travel Notice

Inform us of your travel plans to ensure your card works seamlessly while you’re away.

Limit Increases

Request a credit limit increase directly through the online/mobile platform when you need it.

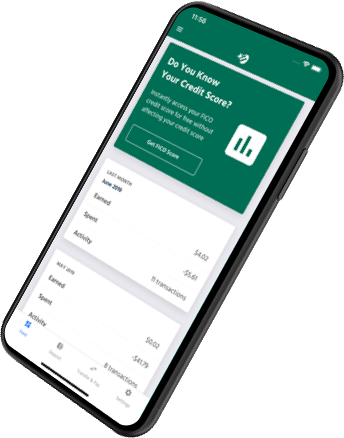

Get Started with Mobile Banking in 3 simple steps

Enroll in Online Banking

To use mobile banking, you’ll first need an online banking account. Visit our online banking enrollment page and follow the prompts to get started.

Download the Mobile App

Once you’re enrolled in online banking, download the Freedom Credit Union mobile banking app from your device’s app store (Apple App Store or Google Play Store).

Log in and Get Started

Open the app and log in using the same username and password you created for online banking. Now you’re ready to experience the convenience of mobile banking!

“Freedom was very comforting in helping me access my account on mobile. Truly world-class service!”